Solo 401 k Loan: What could go wrong without proper knowledge?

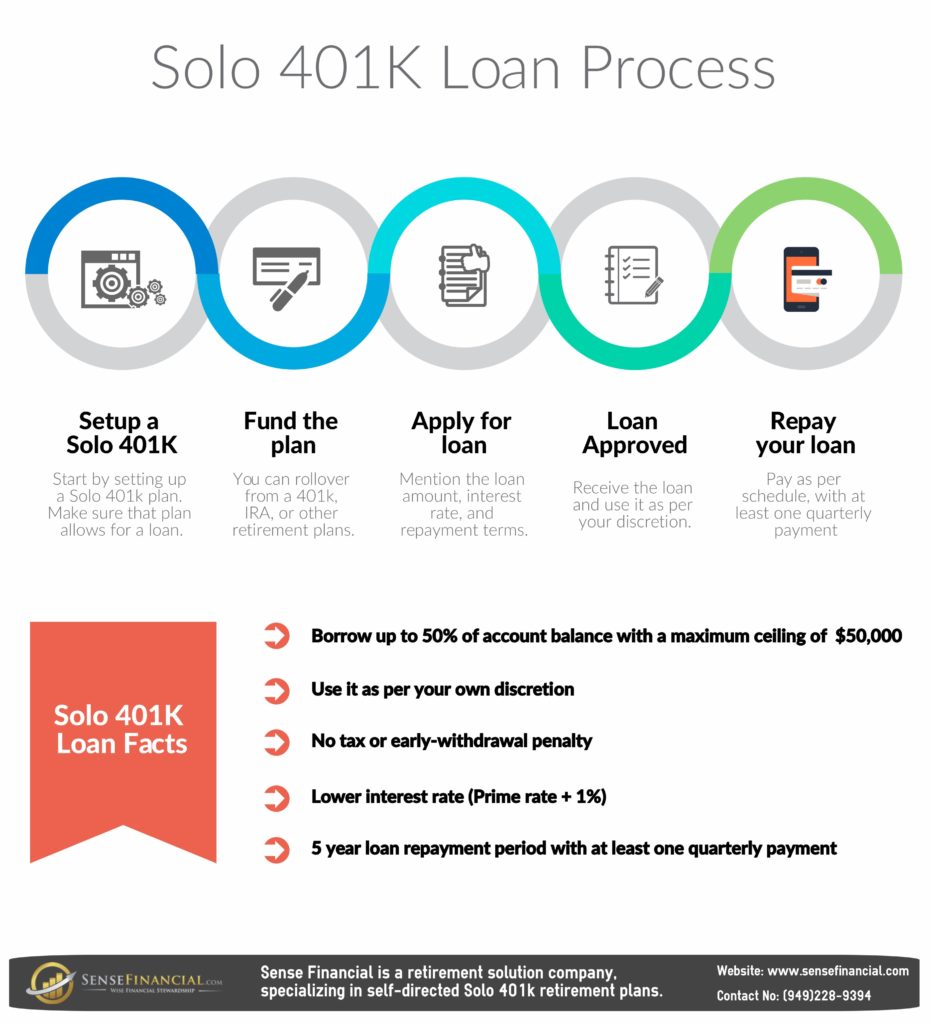

Ask any financial expert, dipping into your retirement savings is the last piece of advice you could expect. However, some circumstances require urgent attention and your retirement savings can offer the much needed financial cushion. If you’re an owner-only business or self-employed professional with a Solo 401k plan, the IRS allows you to borrow from your retirement plan. You can avail a Solo 401 k loan of up to $50,000 or 50% of your plan assets. Interesting! However, there’s more to learn before borrowing from your retirement savings.

Can you borrow from your Solo 401k plan?

One of the prerequisites of availing a Solo 401 k loan is its provision in your plan adoption documents. Solo 401k plans provided by financial institutions for no fee, often, do not offer a participant loan. On the contrary, open-architecture and custodian Solo 401k plans allow eligible participants to borrow from their plans.

A Solo 401 k loan is critical for small business owners and proprietors with limited access to credit. When choosing your plan, make sure to have the borrowing option, so that you can use retirement funds without triggering any tax or early-withdrawal penalties.

- Maximum borrowing limit: $50,000 or 50% of account balance, whichever is lower.

Note: If there is any other outstanding loan on the plan, then the maximum borrowing limit is reduced by the outstanding loan amount.

- Repayment term: Like any other loan, you need to repay the Solo 401k loan within an amortization period of five years, with at least one compulsory quarterly payment.

- Interest rate: The interest rate is either the current prime rate or 1% above the prime rate.

How can you use a Solo 401 k loan?

Unlike traditional commercial/business loans, you can use a Solo 401 k loan for pretty much anything and everything.

- Buy new inventory or machinery for business growth.

- Use it for personal expenses.

- Pay college tuition or credit card debt.

- Handle medical or financial emergencies.

- Make a down payment for a promising real estate deal.

What if the loan goes bad?

There are some circumstances under which your Solo 401 k loan will be considered in the default state.

- You have not paid the loan within the defined amortization period (5 years).

- The loan amount exceeds the maximum permissible limit.

- You have made late repayments or the quarterly payment schedule is not followed.

If your loan defaults, the first step is to cure the loan, only if your plan documents allow it. Usually, you can cover any missed quarterly payment within that quarter only. However, if you’re unable to resolve the issue:

- Your loan will be considered as a taxable distribution.

- If you’re under the eligible retirement age, you’ll also trigger early-withdrawal penalties.

Word of advice

A Solo 401 k loan is a financial cushion you should use only when you have no other alternatives. When borrowing from your Solo 401k plan, make sure to follow the above guidelines, and seek professional advice when necessary. Image credits: https://pixabay.com/en/debt-loan-credit-money-finance-1500774/

© 2024 Created by Admin.

Powered by

![]()

You need to be a member of Real Estate Finance to add comments!

Join Real Estate Finance